CAPITAL ONE CREDIT CARD APPLICATION SUMMARY REDESIGN

JANUARY 2019 - APRIL 2019

Working with business and marketing partners, I redesigned the credit card summary section of Capital One’s credit card application. This was done in order to improve the way Capital One communicates the benefits and value of their credit card products in the application experience. The goal is to increase conversion by highlighting the most important benefits of Capital One’s credit card products in the application. Conversion in this case is the number of approved applications compared to the total number of submit applications

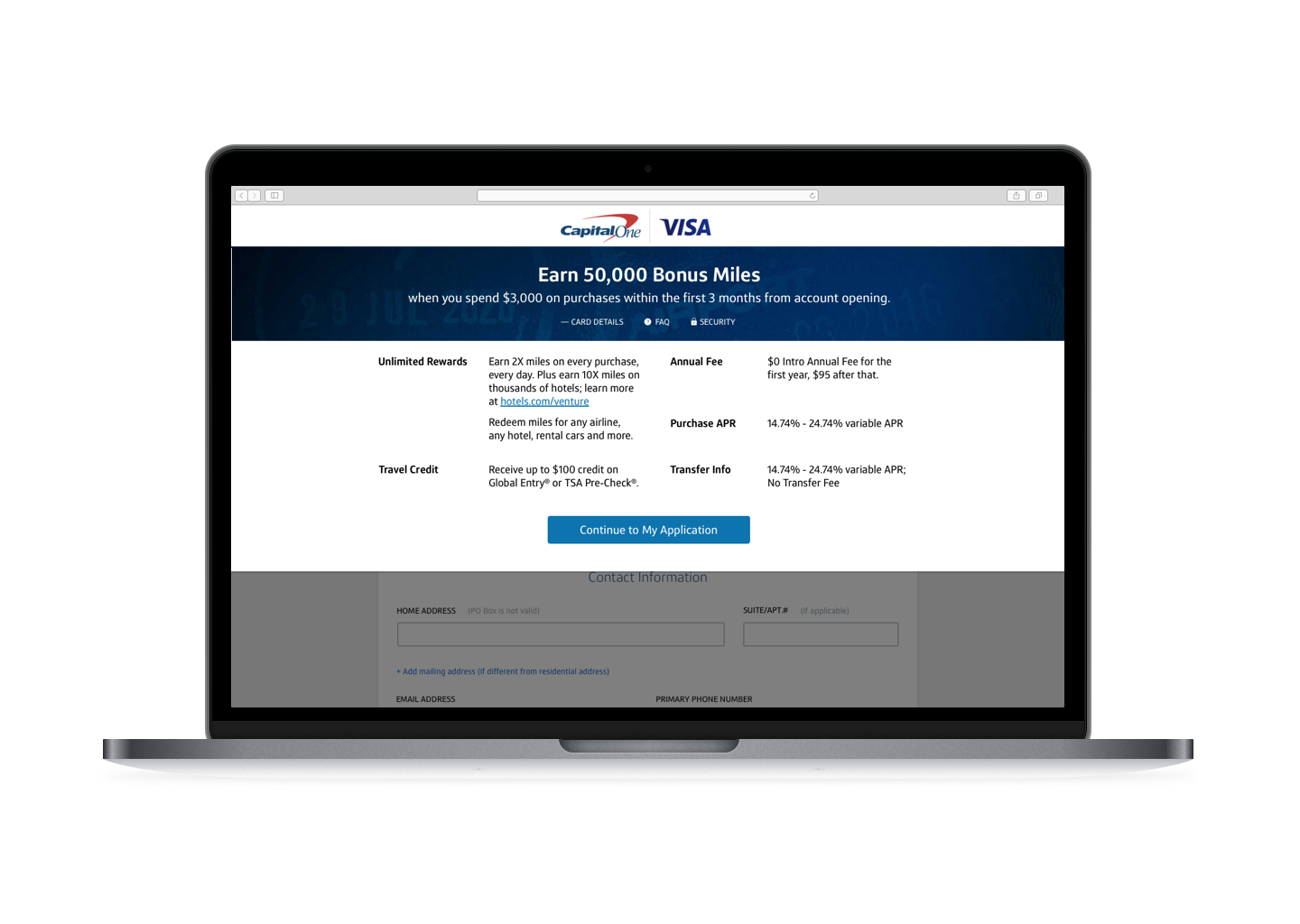

ORIGINAL CARD SUMMARY

The original card summary does not display additional benefits other than the earn rate, APR and the annual fee. While this information is needed in the credit card application, applicants and customers are more inclined to apply if they are aware of the additional benefits to using the card. Research from previous studies suggests customers care most about the early spend bonus when researching a credit card.

COMPARATIVE ANALYSIS

My design process began with comparative research of different competitor’s credit card applications. Working with my product partner and marketing partner, we created an inventory of the different benefits displayed on the different competitor’s credit card applications. We found that most competitors highlight the early spend bonus, the earn rate, as well as the annual membership fee.

Based on previous research studies done by Capital One, we identified that customers want to see benefits including the early spend bonus, the number of points earned with each purchase, and the annual fee.

Competitive Analysis and Inventory of Benefits

WIREFRAMES,

After taking inventory of what needed to be included in the new designs, I began sketching concepts. I focused on changing the layout, as well as the order of information within the credit card summary of the application. I considered the implications of changing the application design, as well as how the designs would translate to mobile. In addition to layout changes and order of information displayed, I considered using modals, tabs, drawers, mud flaps as well as lists, columns and grid views.

Concept Sketches

CRITIQUE

As a way to include my partners in the design process, I presented my digitized wireframes to the product manager, marketing partner, and engineering team. I wanted to get their feedback as earlier as possible and to keep everyone on the same page in terms of the design progress. By critiquing the designs as a team, we were able to identify three versions to implement through multi-variant testing. Once we agreed on the 3 variants to push to testing, I worked closely with the engineering team to prepare for launch.

Critique

FINAL DESIGNS

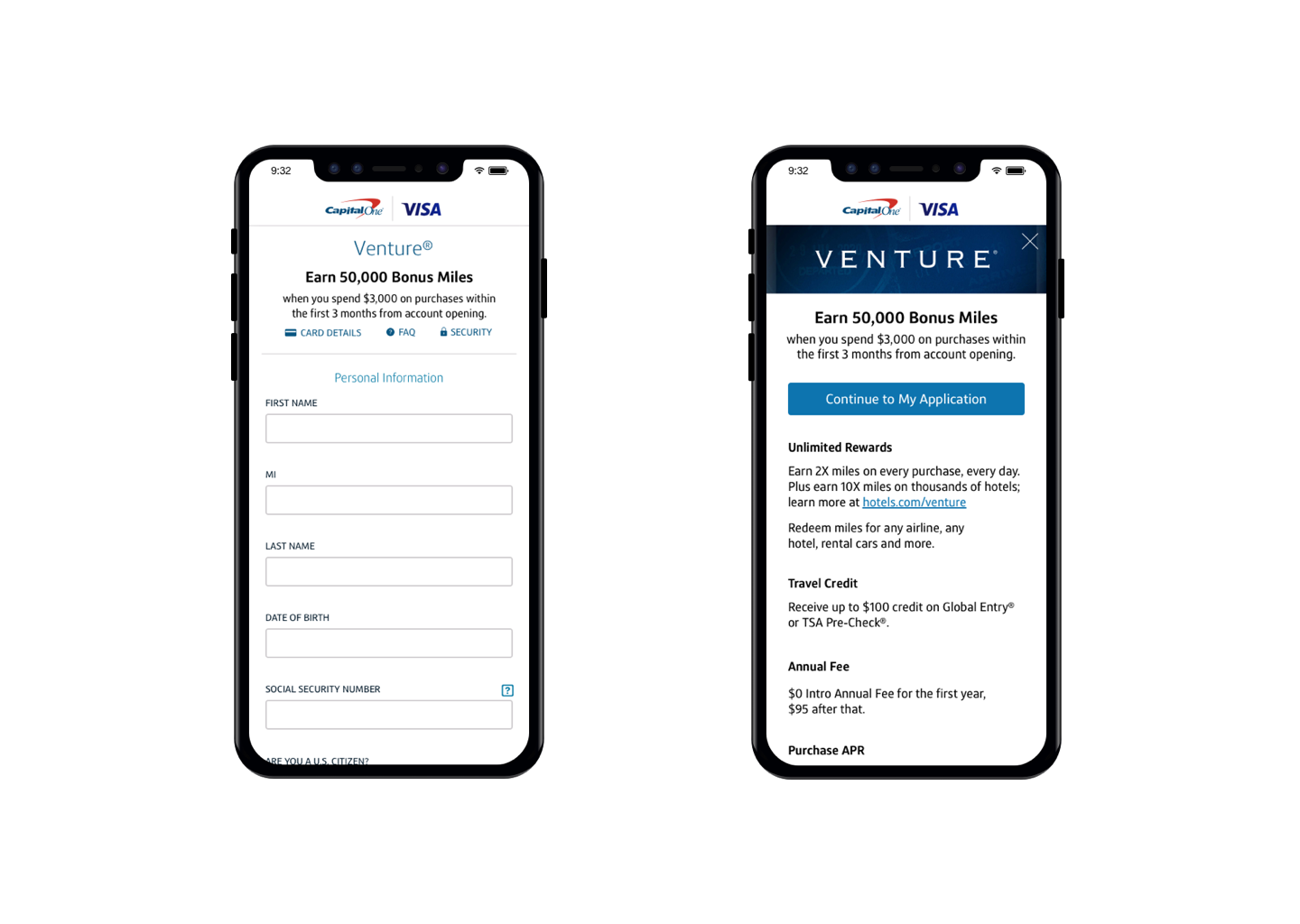

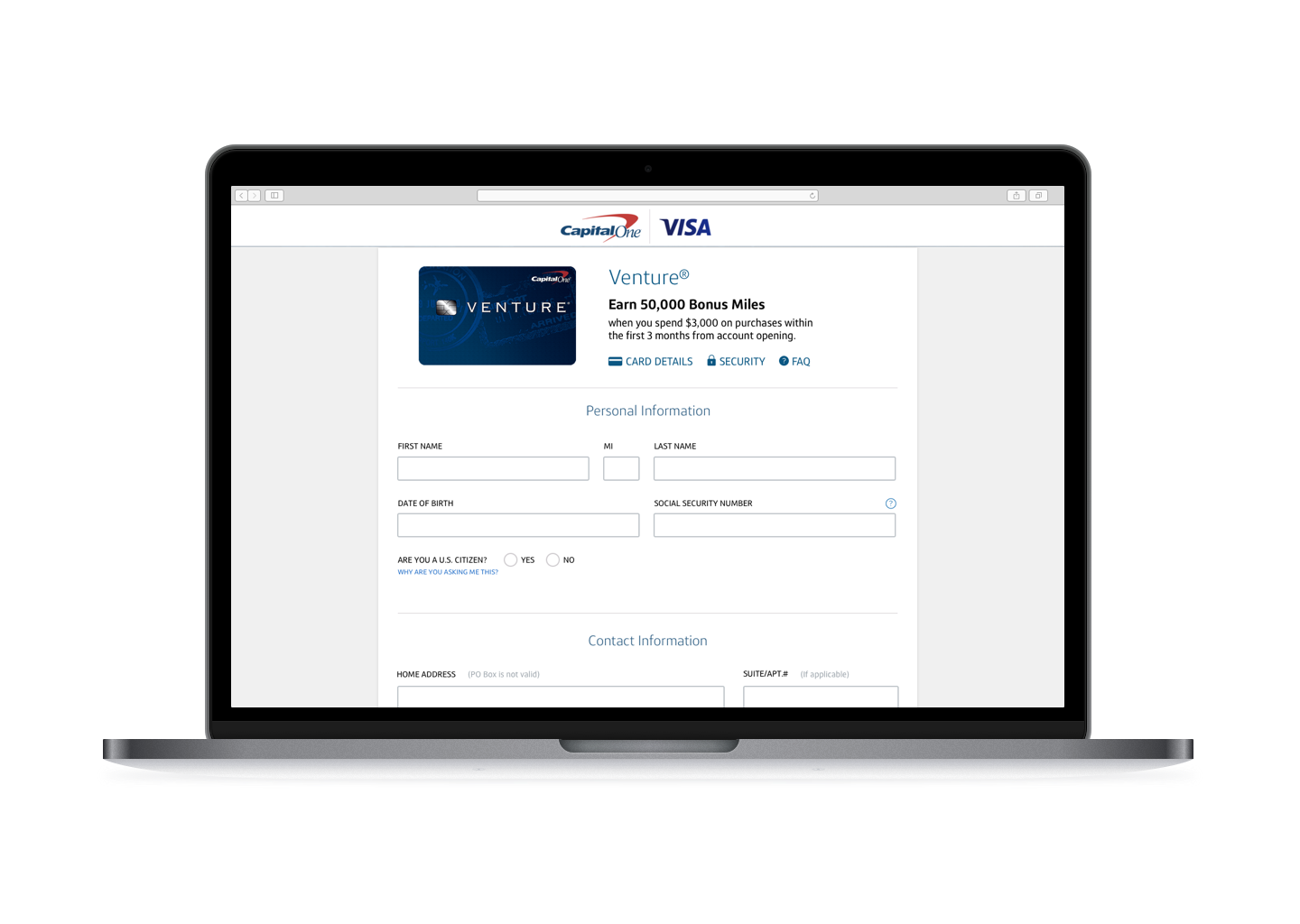

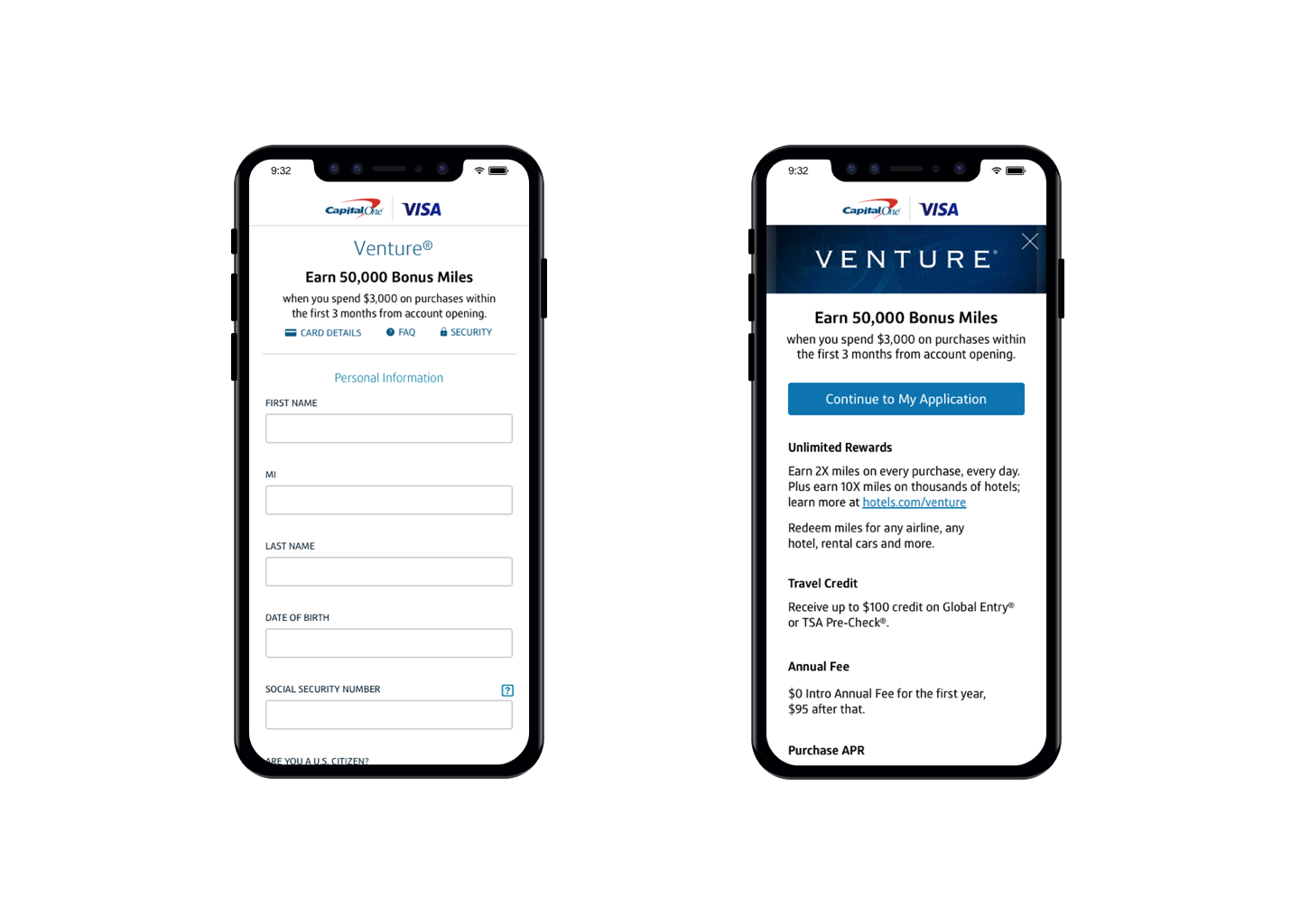

The final designs consist of three variants, each with different layouts, behaviors and affordances in displaying the benefits of the credit card product. Each variant displays the early spend bonus as the most prominent benefit while also showing the additional perks and rewards of using the credit card.

Through multi-variant testing, we are able to see how applicants respond to each version based on the number of submit and approved applications. This will inform future design decisions and eventually lead to a redesign of other Capital One credit card applications.

The mudflap variant

SUCCESS METRICS & IMPACT

Each variant was projected to increase conversion by 5%. Instead, from the initial launch of the study we saw:

The first variant, the mudflap variant, saw an increase in conversion by 17%

The second variant, the 2 column variant, saw an increase in conversion by 5%.

The third variant, the card art at top variant, saw an increase in conversion by 1.5%

This increase in conversion over the 4 month testing period generated an additional $5.5 billion in annual spend.

I left Capital One by the end of the study. The plan prior to my departure was to increase the percentage of traffic for the mudflap variant. Nevertheless, the impact of the variants can still be seen today in Capital One’s credit applications.